We’re delighted to have you here!

At Wealth Wisdom, we believe that prudent planning is the cornerstone of a secure and fulfilling future. Whether you’re just starting your investment journey or looking to grow and protect your wealth, explore our services, insights, and tools designed to empower you at every stage of your financial journey.

Driven by transparency, research-driven strategies, and personalized service, we strive to simplify the complex world of finance for you.

Let’s build a path to your financial freedom — together.

Welcome aboard!

There is no single solution that can cater to all clients. Identifying their needs and problem areas is the cornerstone of defining our role in their lives.

We concentrate on comprehending their distinctive circumstances, objectives, and investment preferences through a personalized process.

With a clear focus on Asset Allocation, Security Selection, and Regular Review, we endeavor to optimize portfolio performance with a degree of predictability.

We employ a comprehensive interdisciplinary approach that integrates economic analysis, securities research, tax expertise, investment management, and financial planning to devise customized “Strategic Allocation” plans.

This allocation strategy transcends broad asset classes and encompasses sub-classes as well. We have meticulously crafted allocation templates that align precisely with the distinctive investment profile of each client. These templates undergo annual review to maintain their accuracy and relevance.

We employ in-house security selection metrics to publish our periodic Wish List. These metrics evaluate both quantitative and qualitative parameters.

Our objective is to allocate and retain funds in consistently performing products for all market-linked investments within our clients’ portfolios.

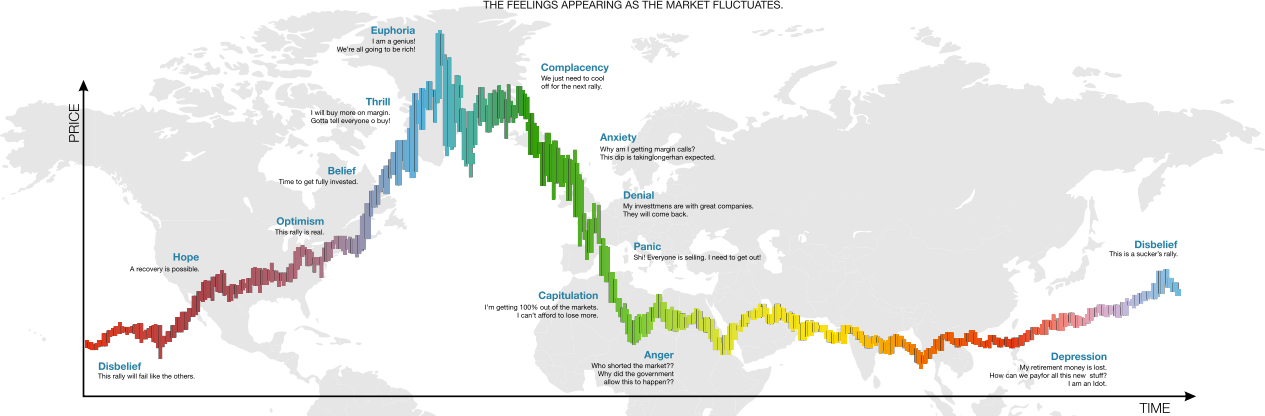

Market timing entails purchasing an asset class at a low price and selling it at a higher price. However, we firmly believe that market timing is virtually impossible, which is why we do not employ tactical allocation in our investment philosophy. Instead, we periodically review and rebalance mismatched allocation, which inadvertently leads to market timing.

When there is a mismatch in our allocation, we sell a portion of an asset that has appreciated and purchase an asset whose price is the same or lower. In essence, we sell at a high price and purchase at a low price.

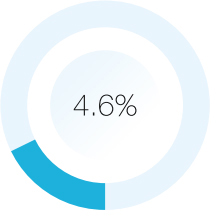

Individual scheme, stock, or bond selections contribute relatively little to incremental performance.

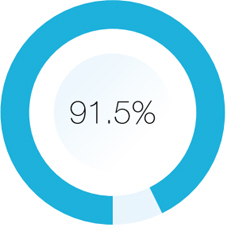

The primary driver of long-term returns is the optimal allocation of assets, including equities, bonds, cash, and alternative investments.

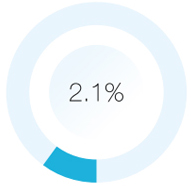

Tactical market timing attempts have a minimal impact on overall performance.

Fees, trading costs, and miscellaneous decisions account for a small percentage of portfolio outcomes.

Wealth Wisdom have a very professional and highly skilled team who provides quality service and great returns. Romil completed a comprehensive assessment of our financial needs and goals. They combine adaptability with sharp lateral thinking to create innovative strategies tailored to each client’s unique needs.

I have had a very positive experience working with Wealth Wisdom Investech Pvt. Ltd., especially with Romil Singhal, who has been managing my financial portfolio. His strategic approach and sound advice have helped me grow my wealth in a secure and consistent manner. Romil is highly knowledgeable, approachable, and always willing to take the time to guide me in the right direction. His insights and personalized recommendations have added great value to my financial planning. I truly appreciate the professionalism and commitment shown by Romil and the Wealth Wisdom team, and I look forward to continuing this successful association.

It’s been over five years since I entrusted my finances to Mr. Romil Singhal, and the journey has been nothing short of exceptional. He has been more than a financial advisor — he’s a trusted guide and strategist who truly understands both the market and his client’s needs. Romil ji is meticulous in managing finances and constantly adapts the debt-to-equity ratio in response to changing trends. His foresight, market acumen, and commitment to profitability have given me immense confidence in my financial journey. He has recommended the most suitable insurance policies — whether medical, accident, travel, or pension — always keeping my best interest at heart. In a world full of misleading financial products, having someone so honest and discerning is rare. His advice on stocks and IPOs has been timely and accurate, always tailored to my personal goals. Thanks to his expertise, my portfolio is now diverse, safe, and steadily growing. I’ve seen the benefits first-hand, and I’ve referred him to many friends and family members — including my sister-in-law and best friend — who are now happy clients too. I truly believe that Mr. Romil Singhal and Wealth Wisdom embody integrity, intelligence, and genuine care for their clients. My best wishes to him always.

I can't thank Wealth Wisdom Investech enough for the incredible support and guidance they’ve provided in managing my finances. Their expertise, patience, and genuine care have helped me feel more confident and secure about my family's financial future. For all my investment strategies, they always take the time to explain options clearly and tailor recommendations to my specific goals. It's rare to find someone so knowledgeable and trustworthy like Mr Romil Singhal & his Team. I'm truly grateful to have them by my side. Highly recommended!

I got to know about Wealth wisdom almost 4 years back and since then have relied completely on their strategic and personalised guidance in shaping up my financial future. Romil in particular has been instrumental with managing my funds and investments and the outcome has always met my expectations . I now feel confident about my financial future and would like to thank both Romil and Wealth wisdom for all their guidance and support.

Wealth Wisdom (WW) has played an instrumental role in helping me achieve my financial goals through expert guidance and a personalized approach. I’ve been working closely with Romil Singhal, whose professionalism and commitment are truly commendable. His exceptional service has made 'WW' my trusted partner for all mutual fund-related needs. Additionally, he has generously offered valuable advice beyond mutual fund matters from time to time. I sincerely wish him and the entire team at 'WW' continued success and a bright business ahead.

I've had a fantastic experience with Wealth Wisdom! In the past, managing my finances to meet my short-, mid-, and long-term goals felt overwhelming. But Wealth Wisdom has completely changed that. They combine deep financial expertise with a truly client-first approach, making the whole process clear and approachable. It genuinely feels like having a financially savvy friend by your side, rather than just another advisor. With their guidance, I feel far more in control of my finances, and confident that my money is being put to work in the right way. I highly recommend them to anyone looking for a trustworthy and supportive financial partner.

Risk Factors – Investments in Mutual Funds are subject to Market Risks. Read all scheme related documents carefully before investing. Mutual Fund Schemes do not assure or guarantee any returns. Past performances of any Mutual Fund Scheme may or may not be sustained in future. There is no guarantee that the investment objective of any suggested scheme shall be achieved. All existing and prospective investors are advised to check and evaluate the Exit loads and other cost structure (TER) applicable at the time of making the investment before finalizing on any investment decision for Mutual Funds schemes.

We deal in Regular Plans only for Mutual Fund Schemes and earn a Trailing Commission on client investments. Disclosure For Commission earnings is made to clients at the time of investments. Option of Direct Plan for every Mutual Fund Scheme is available to investors offering advantage of lower expense ratio. We are not entitled to earn any commission on Direct plans. Hence we do not deal in Direct Plans.

AMFI Registered Mutual Fund Distributor | ARN-176981 | Date of Initial Registration: 16/03/2021 | Current Validity: 15/03/2027

Copyright © 2025 Wealth Wisdom Investech Private Limited. All rights reserved.

Disclaimer | Disclosure | Privacy Policy | Terms & Conditions | SID/SAI/KIM | AMFI Risk Factors | Code of Conduct | SEBI Circulars